High 10 Chart Patterns for Technical Merchants: A Complete Information

Associated Articles: High 10 Chart Patterns for Technical Merchants: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to High 10 Chart Patterns for Technical Merchants: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

High 10 Chart Patterns for Technical Merchants: A Complete Information

Chart patterns are visible representations of value motion that may assist technical merchants predict future value actions. They’re fashioned by the interaction of provide and demand, reflecting the collective conduct of market contributors. Whereas no sample ensures success, understanding and appropriately figuring out these patterns can considerably enhance buying and selling accuracy and danger administration. This text explores ten of essentially the most prevalent and dependable chart patterns, providing insights into their formation, interpretation, and buying and selling methods.

1. Head and Shoulders (H&S): A Reversal Sample

The Head and Shoulders sample is a basic bearish reversal sample, indicating a possible shift from an uptrend to a downtrend. It is characterised by three distinct peaks: a central "head" that is increased than the 2 flanking "shoulders." A "neckline," a trendline connecting the lows between the pinnacle and shoulders, supplies essential help. A break under the neckline confirms the sample, with the worth goal typically projected as the gap between the pinnacle and the neckline, measured down from the breakout level. A bullish H&S mirrors this, with the sample reversed.

- Formation: Three distinct peaks (head and two shoulders) with a neckline connecting the troughs.

- Affirmation: Break under (bearish) or above (bullish) the neckline.

- Goal: Measured transfer from head to neckline projected downwards (bearish) or upwards (bullish).

- Limitations: False breakouts can happen, requiring affirmation with different indicators.

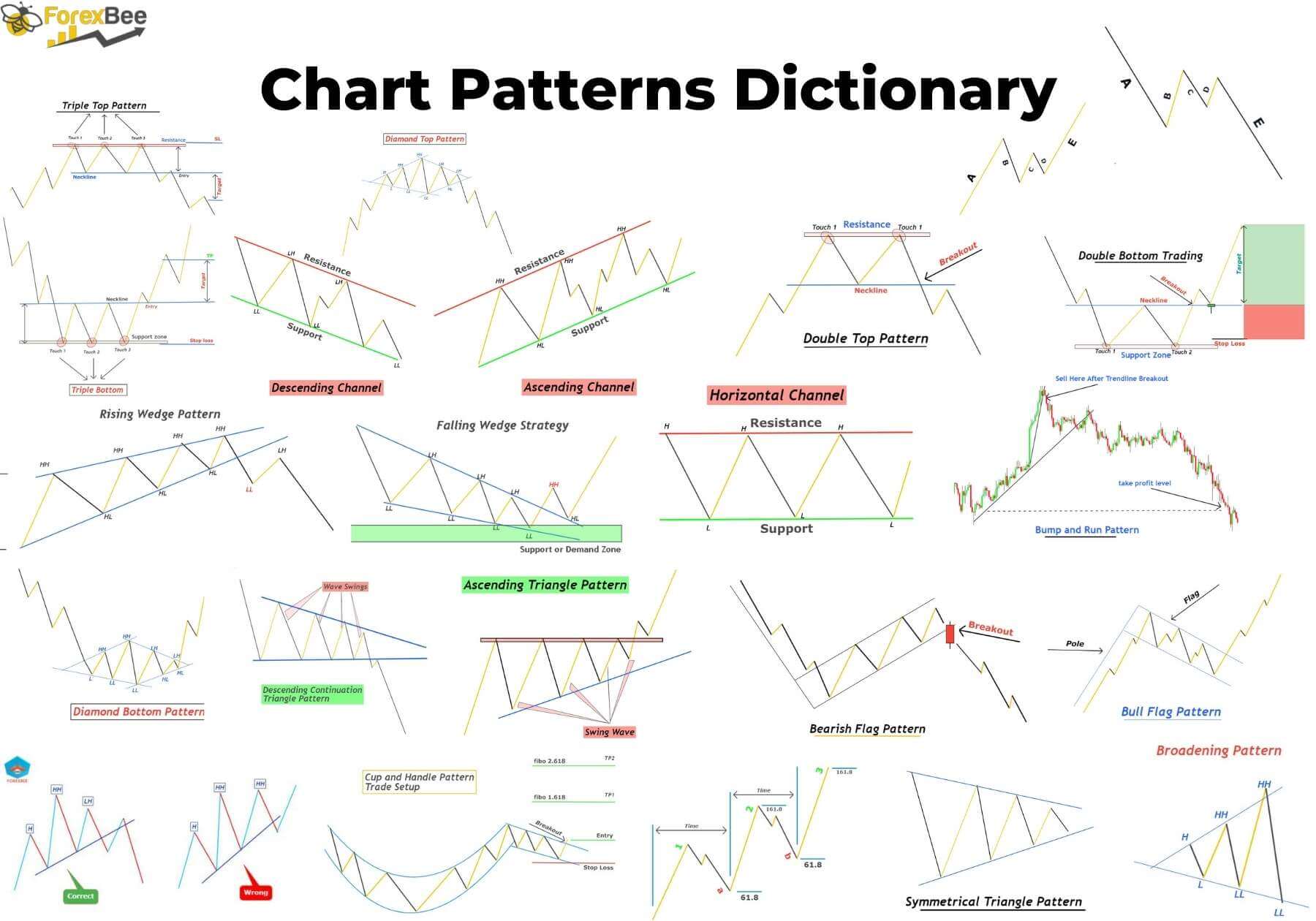

2. Double High/Double Backside: Reversal Patterns

Double High and Double Backside patterns are comparatively easy but highly effective reversal indicators. A Double High types when the worth reaches an analogous excessive twice, failing to surpass it, suggesting weakening bullish momentum. Conversely, a Double Backside types when the worth hits an analogous low twice earlier than rebounding. The neckline connecting the 2 peaks (Double High) or troughs (Double Backside) acts as a vital help/resistance stage.

- Formation: Two comparable highs (Double High) or lows (Double Backside).

- Affirmation: Break under (Double High) or above (Double Backside) the neckline.

- Goal: Measured transfer from the neckline to the height/trough projected downwards (Double High) or upwards (Double Backside).

- Limitations: Requires clear value motion and affirmation from quantity and different indicators.

3. Triple High/Triple Backside: Reversal Patterns

Just like Double Tops/Bottoms, Triple Tops/Bottoms signify stronger reversal indicators as a result of elevated affirmation of value rejection on the identical stage. Three comparable peaks (Triple High) or troughs (Triple Backside) point out a stronger battle between patrons and sellers earlier than a decisive breakout.

- Formation: Three comparable highs (Triple High) or lows (Triple Backside).

- Affirmation: Break under (Triple High) or above (Triple Backside) the neckline.

- Goal: Measured transfer from the neckline to the height/trough projected downwards (Triple High) or upwards (Triple Backside).

- Limitations: Requires endurance and affirmation; false breakouts are potential.

4. Cup and Deal with: Continuation Sample

The Cup and Deal with sample is a bullish continuation sample, suggesting a pause in an uptrend earlier than resuming its upward trajectory. The "cup" resembles a U-shaped curve, representing a interval of consolidation. The "deal with" is a brief, downward trendline, which acts as some extent of entry. A breakout above the deal with’s excessive confirms the sample.

- Formation: U-shaped cup adopted by a brief downward sloping deal with.

- Affirmation: Breakout above the deal with’s excessive.

- Goal: Measured transfer from the cup’s backside to its excessive, projected upwards from the breakout level.

- Limitations: The deal with’s size and slope are essential; too deep or lengthy a deal with can invalidate the sample.

5. Flags and Pennants: Continuation Patterns

Flags and Pennants are short-term continuation patterns that point out a brief pause in a powerful development. Flags are characterised by an oblong consolidation, whereas Pennants exhibit a triangular consolidation. Each patterns sign a resumption of the prior development after a short interval of consolidation.

- Formation: Rectangular (Flag) or triangular (Pennant) consolidation inside a powerful development.

- Affirmation: Breakout within the path of the prior development.

- Goal: The goal is usually the identical as the unique development’s transfer, projected from the breakout level.

- Limitations: Brief-lived patterns; requires figuring out the prevailing development earlier than getting into a commerce.

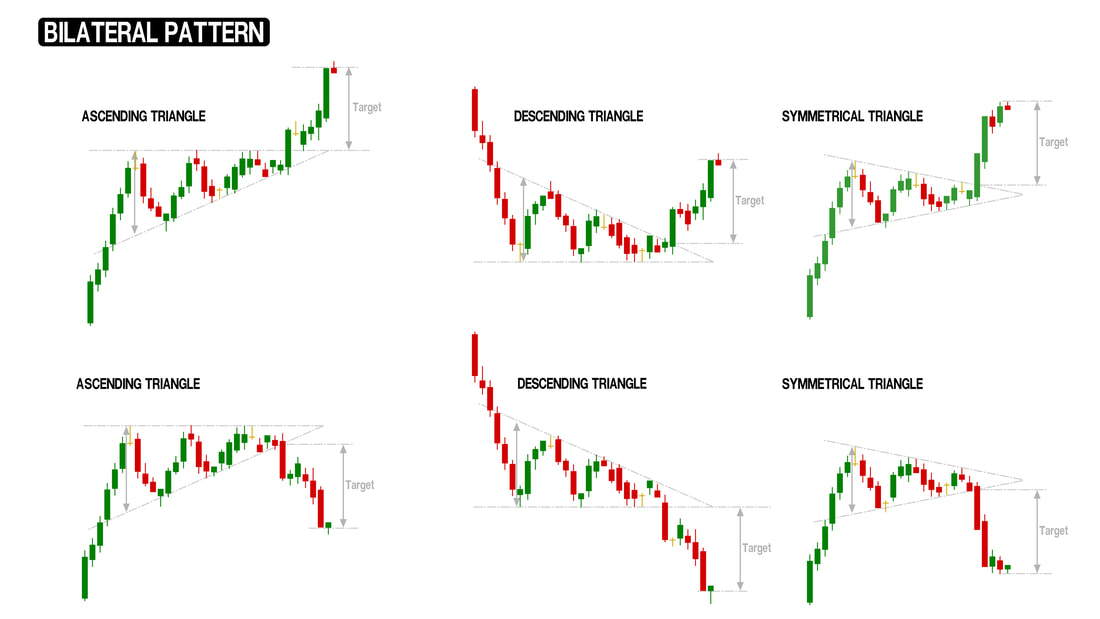

6. Triangles: Continuation or Reversal Patterns

Triangles are versatile patterns that may act as both continuation or reversal patterns, relying on the broader market context and the kind of triangle. Symmetrical triangles recommend a interval of indecision, whereas ascending triangles are bullish and descending triangles are bearish.

- Formation: Converging trendlines forming a triangular form.

- Affirmation: Breakout above (ascending or symmetrical) or under (descending or symmetrical).

- Goal: For continuation patterns, the goal is normally the peak of the earlier development, projected from the breakout level. For reversal patterns, the goal is much less predictable.

- Limitations: Breakouts may be false; affirmation from quantity and different indicators is essential.

7. Rectangles: Continuation Patterns

Rectangles are horizontal consolidation patterns characterised by parallel help and resistance ranges. They sometimes point out a interval of indecision earlier than the worth breaks out within the path of the prevailing development.

- Formation: Horizontal parallel help and resistance ranges.

- Affirmation: Breakout above (bullish) or under (bearish) the resistance or help.

- Goal: Measured transfer from the breakout level equal to the peak of the rectangle.

- Limitations: Will be troublesome to differentiate from sideways buying and selling; requires affirmation from quantity and different indicators.

8. Broadening Formations: Reversal Patterns

Broadening formations, together with broadening wedges and broadening tops/bottoms, are characterised by increasing value swings. These patterns sometimes sign rising volatility and a possible reversal of the present development. They’re much less dependable than different patterns and require cautious interpretation.

- Formation: Increasing value swings forming a widening sample.

- Affirmation: A decisive break exterior the sample’s boundaries.

- Goal: Troublesome to foretell precisely; requires affirmation from different indicators.

- Limitations: Excessive volatility and fewer dependable than different patterns.

9. Inverse Head and Shoulders: Reversal Sample

The Inverse Head and Shoulders is the bullish counterpart to the Head and Shoulders sample. It indicators a possible reversal from a downtrend to an uptrend. It options three troughs with a central "head" that’s decrease than the 2 flanking "shoulders." A "neckline" connects the peaks between the pinnacle and shoulders. A break above the neckline confirms the sample.

- Formation: Three distinct troughs (head and two shoulders) with a neckline connecting the peaks.

- Affirmation: Break above the neckline.

- Goal: Measured transfer from head to neckline projected upwards.

- Limitations: False breakouts can happen, requiring affirmation with different indicators.

10. Diamond Sample: Reversal Sample

The Diamond sample resembles a compressed broadening formation that finally contracts. It’s a reversal sample, indicating a major change in development path. The sample begins with increasing value swings, then contracts, converging to a degree. A breakout from this level confirms the sample.

- Formation: A diamond form created by increasing after which contracting value swings.

- Affirmation: Breakout above (bullish) or under (bearish) the converging trendlines.

- Goal: The goal is usually the width of the widest a part of the diamond, measured from the breakout level.

- Limitations: Requires endurance and affirmation; false breakouts are potential.

Conclusion:

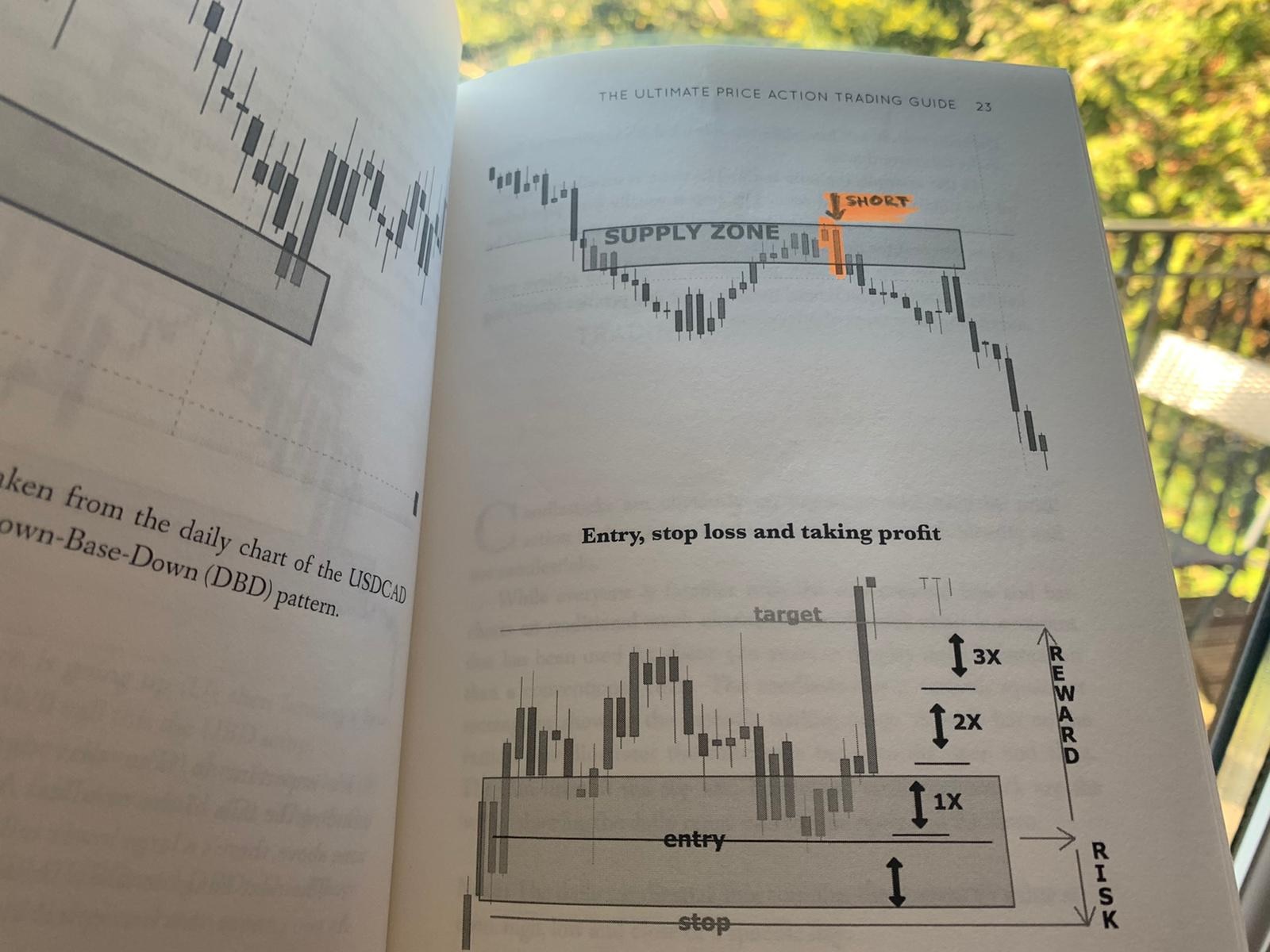

Chart patterns present useful insights into market sentiment and potential value actions. Nevertheless, it is essential to keep in mind that they don’t seem to be foolproof predictors. Profitable chart sample buying and selling requires a mixture of technical evaluation, danger administration, and affirmation from different indicators reminiscent of quantity, transferring averages, and oscillators. At all times apply danger administration methods like stop-loss orders and place sizing to guard your capital. Constant studying and apply are important for mastering the artwork of chart sample recognition and buying and selling. Contemplate backtesting your methods utilizing historic information to evaluate their effectiveness earlier than making use of them to stay buying and selling.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has offered useful insights into High 10 Chart Patterns for Technical Merchants: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!